The Government Accountability Office (GAO) revealed in a September 16th report that the “IRS Is Developing a New Modernization Framework.” The pause in their current modernization efforts comes on the heels of extensive modernization efforts. As of September 2024, the IRS had 23 modernization programs delivered in what looked like a major upgrade for the IRS IT systems. These programs ranged from customer experience upgrades to behind-the-scenes system replacements. According to the GAO, most of them were successfully delivered on schedule for fiscal year 2024.

On the surface, that looked like a successful effort. The agency spent about $1.5 billion on modernization in 2024, coming in roughly $512 million underbudget. Still, in March 2025, the IRS told the GAO that it would be pausing its modernization programs to reevaluate its priorities. The agency then introduced a new framework that included nine new initiatives that would replace the 23 programs.

What Happened at the IRS?

The unexpected change in direction highlights the challenges that can come with modernization. The process may sound straightforward on the surface – buy some new tech from smart people, retire the old stuff, and everything runs smoother. But the reality is that modernization can be messy. Strategy and planning can be just as important as the systems and purchasing.

And it appears that the Internal Revenue Service (IRS) is experiencing that reality. Over the last several years, these IT programs were expected to replace legacy systems and improve the way it serves taxpayers. But the new initiatives tellingly include a focus on developing a “unified application program interface.” Translation: it has to work, and it all has to work together.

Imagine: the $1.5 billion modernization spend in 2024 was just a part of the $5 billion the IRS spent on IT in 2024. What kinds of bottlenecks, incompatibilities, and complete failures could result from being unable to unify all of those investments?

Lessons Learned

For businesses, the IRS’s pivot holds important lessons. Many organizations, especially those with aging tech stacks and scattered modernization efforts, can face the same problems, albeit at a much smaller scale.

Roadmaps and workflows with milestones and work descriptions may look impressive on paper, but many don’t fully address what will happen to the legacy systems they are supposed to replace. Of the 23 IRS modernization programs, 15 of them needed clear disposition plans. Only 10 did. For anyone who has ever tried to shut down an old platform, that’s a red flag.

By early 2025, the IRS has made a bold choice. It pressed pause on expensive programs in the realization that they are going to need to build a new framework. Instead of dozens of parallel and potentially incompatible efforts, the agency is moving to nine broader initiatives. That’s a left-turn that can represent a lot of lost money if not handled carefully.

Why This Matters Outside Government

It’s tempting to look at the IRS and think, “that’s government scale. It doesn’t apply to us.” But the core issues the GAO identified should feel familiar to any business trying to modernize.

First: scope creep can sneak up on anyone. Running too many initiatives at once and/or using too many contractors is a recipe for confusion. Teams lose focus, budgets get spread thin, and leadership struggles to prioritize. That’s not just a government problem. It’s a corporate one.

Second: legacy drag. Old systems do more than just cost money to maintain. They slow integration, limit agility, and increase security risk. The IRS’s incomplete plans for legacy retirement echo what many companies face: it’s easy to build new, harder to let go of the old.

Third: planning discipline. Having a thorough roadmap isn’t optional. Milestones, documented scope, and clear end states keep projects from drifting. Without them, organizations often can’t tell if they’re making progress or just spending money.

And finally, showing the willingness to reprioritize if things aren’t working. The IRS’s decision to pause and rethink its approach probably wasn’t easy, but it was smart. Too often, companies keep funding projects simply because they’re already underway, even when they no longer match strategy or reveal too many problems.

The Lessons for Businesses

So what does this look like in practice? Imagine a mid-sized company with several modernization programs underway: a CRM migration, a new data warehouse, a mobile app rebuild, and a cloud security refresh. Each project is owned by a different department and contracted out to a different company. Budgets are allocated, teams are busy, but no one has stepped back to ask whether all of them align with the company’s current goals.

If that company took a page from the IRS’s reset, it might start with an inventory. List every active project. Note its purpose, cost, schedule, and connection to strategic objectives. Then add one critical question: what legacy system is this supposed to replace or transform, and what’s the plan for that system once the project is complete?

That exercise alone can reveal surprising overlap. Maybe two projects are both trying to solve reporting problems in different ways. Maybe one legacy system was supposed to be retired three years ago but is still eating budget. Maybe a high-profile initiative doesn’t actually tie to today’s strategy at all.

From there, the company could consolidate. Instead of fifteen scattered projects, maybe five strategic initiatives are enough. Leadership could reprioritize, cancel or merge efforts, and redirect resources to areas with the most impact.

Of course, finding a company that can handle and synchronize all of these projects at once is ideal to simplify the process.

The Trade-Offs of Simplification

Of course, simplification isn’t painless. When the IRS paused its projects, work stopped. Teams had to regroup. Stakeholders who had invested time and energy into specific programs likely weren’t thrilled. Businesses face the same pushback. Cutting or merging projects often creates political and emotional friction in the workplace.

There’s also the cost factor. Retiring legacy systems isn’t cheap. Maintaining them while building new replacements can create a double-spend problem in the short term. Companies need to weigh whether the long-term efficiency gains justify the upfront pain.

And let’s not forget security. Pausing projects or running legacy systems longer than expected can open vulnerabilities. Transitions must be managed carefully, with risk mitigation baked in.

But the alternative of letting projects multiply unchecked and legacy systems linger indefinitely is worse. That path leads to wasted budget, fragmented operations, and brittle IT environments.

Why Leadership Needs to Drive Change

One of the GAO’s critiques of the IRS was that recommendations from previous audits were left only partially implemented. That points to a leadership issue. Modernization isn’t something that can be left to individual departments or project managers alone. It requires executive ownership.

For businesses, that means leaders need to do more than approve budgets. They must ensure projects tie directly to strategy, push for accountability on milestones, and be willing to make hard calls about reprioritization.

It also means creating a culture that views pausing or canceling projects as healthy, not shameful. A well-timed reset is often the best sign of maturity in a modernization journey.

A Modernization Framework That Works

Looking at the IRS experience, a strong modernization framework for any organization should include:

- Clarity of purpose. Every initiative must connect to a strategic business goal.

- Defined scope and milestones. Projects without them tend to drift.

- Legacy system disposition plans. You can’t just build new; you must plan for the old.

- Regular reassessment. Conditions change. Frameworks should adapt.

- Follow-through. Recommendations from audits, consultants, or lessons learned must be closed, not just noted.

It’s not flashy, but it’s effective.

The Bottom Line

The IRS’s IT modernization reset is more than a government efficiency story. It’s a reminder that modernization isn’t about how many projects you launch, but how well you manage and align them.

For businesses, the lesson is simple: don’t confuse activity with progress. Too many initiatives can dilute focus. Legacy systems won’t retire themselves. And sometimes the smartest move is to hit pause, realign, and move forward with fewer, stronger programs.

Modernization done right requires discipline, prioritization, and courage. If the IRS can admit it needs to step back and rethink its approach, businesses can too. And those that do will find themselves better positioned, not just with new tech, but with stronger, more resilient operations ready for the future.

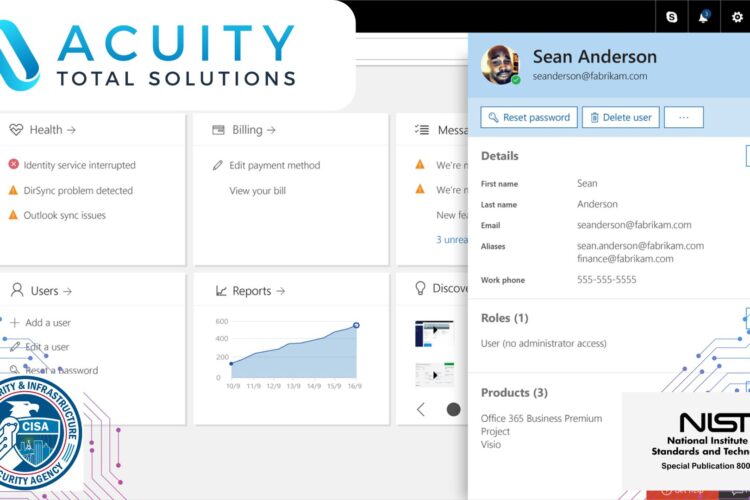

Are you ready to modernize your IT systems? At Acuity, we can handle nearly every type of upgrade imaginable, keeping your goals and outcomes synchronized. Please CONTACT US for more information.